Young Canadians may need to come to terms with the fact policymakers are driving ownership further out of reach every year. Numbers crunched by the Canadian Housing Statistics Program (CHSP) at Statistics Canada (Stat Can) reveals how ownership has changed over the past 50 years. For young adults, homeownership peaked nearly 40 years ago, and while some improvements were made a decade ago, that progress has since been lost.

Canadian Homeownership On The Decline For Young Adults

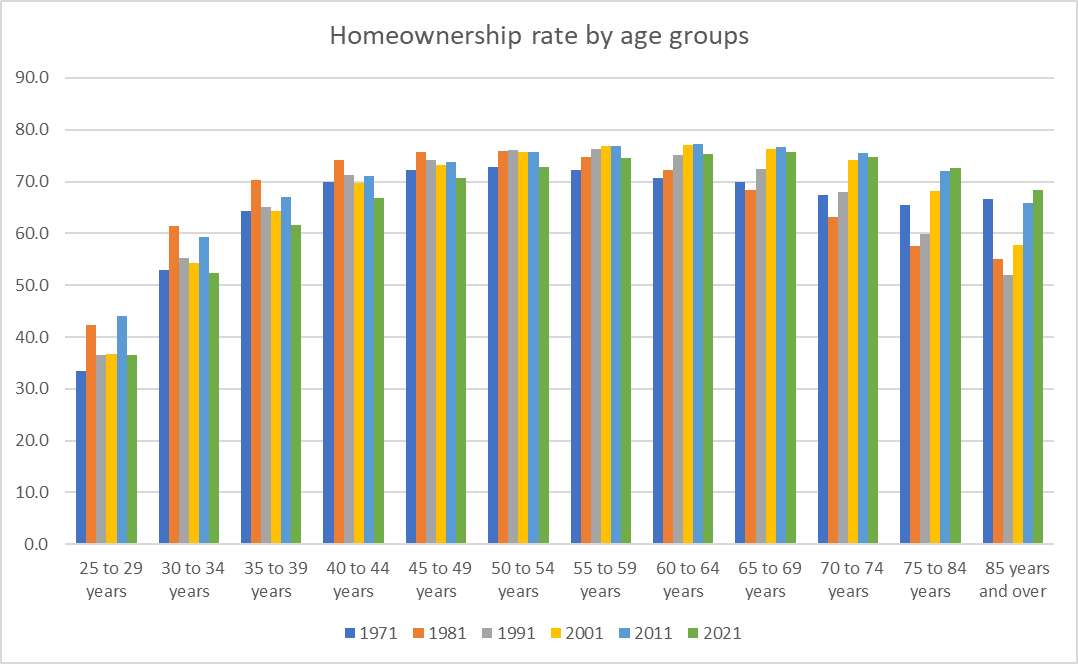

The following chart shows the ownership rate for age cohorts, each bar a snapshot of ownership that year. Years are spaced 10 years apart, helping to minimize any short-term volatility.

Source: Stat Can.

The homeownership rate for young adults has spiraled lower within a span of ten years. Between 2011 and 2021, the ownership rate for those between 25 and 44 has dropped at least 5 points. A decline was also seen for people aged 45 to 74 years old, but not to the same extent.

The only demographic to see an improvement in homeownership was households aged 75 and older. Though survivorship bias is likely to play a role in the statistics. Since wealthier households tend to live longer, the data is likely to slant towards homeowners.

Canadian Homeownership Rate Peaked In The Early 80s, Collapsed As Interest Rates Dropped

Canadian homeownership peaked during the last inflation crisis, more than 40 years ago. Those between the ages of 25 and 54 years old have seen a drop in ownership ranging from 5 to 10 points as of 2021. The sharpest decline was observed between the age of 33 and 44 years old, where the rate fell closer to 10 points.

Boomers (60 years and older) have generally seen ownership rise significantly over the past 40 years. While some cohorts have seen a mild decline within the past decade, the trend has increased more than 10 points since the 1980s.

Easy access to credit is often pitched as a solution to improve ownership, but the data shows the exact opposite. Since interest rates peaked in the early 80s, ownership has slid lower for young adults across Canada. This reflects the findings of Bank of Canada (BoC) researchers that found the past 30 years of falling rates failed to improve affordability, helping to drive home prices higher. The additional leverage provided by low rates also helped investors capture a greater share of the market, with the country’s largest bank warning these investors are displacing first-time buyers.

Naturally, Canadian policymakers are in a rush to get back to a low rate policy.

Welcome to Canadistan