Canadian real estate prices are still seeing record growth, just not when it comes to sales. A new research note from BMO shows annual growth of rental prices grew at a record pace in October. They note the issue is complicated even further by rents outpacing income growth for the first time in 60 years.

Canadian Rental Prices Are Rising At The Fastest Rate Since 1983

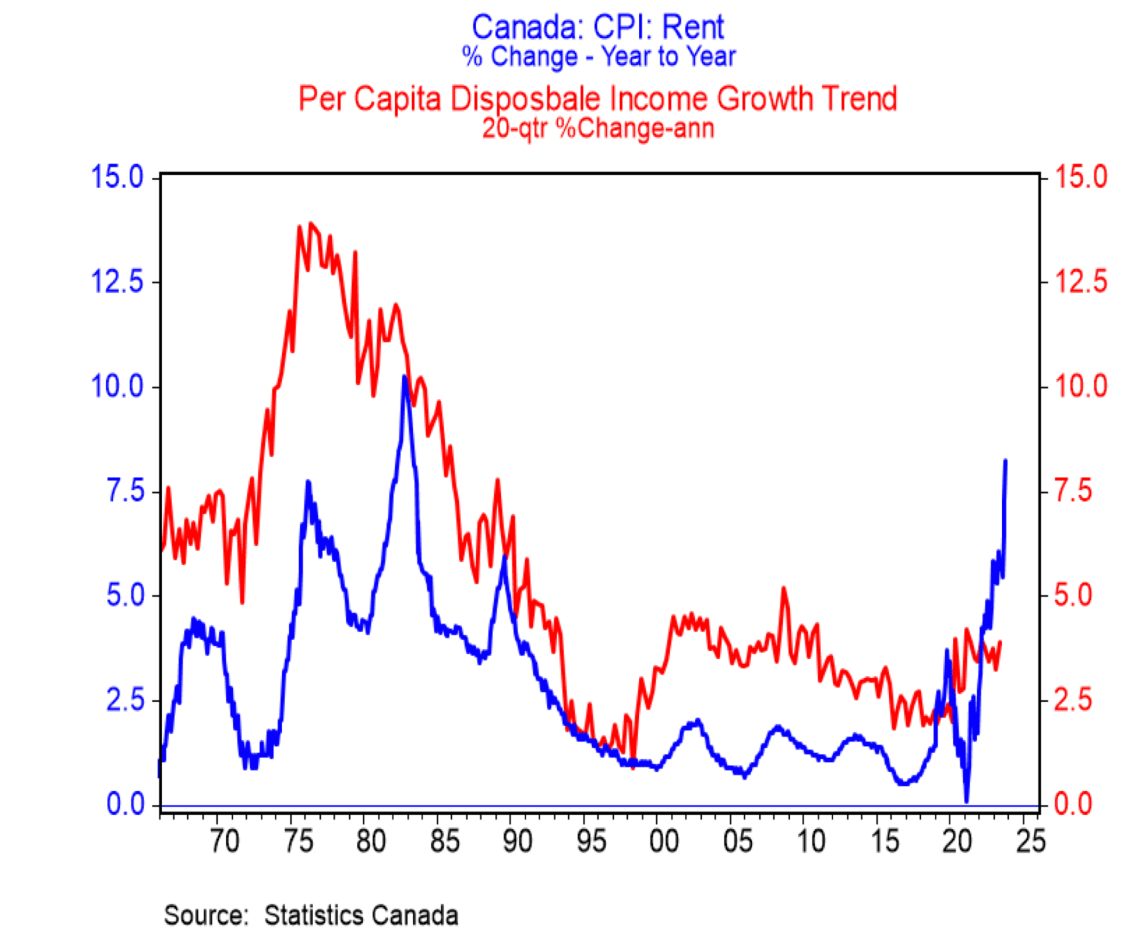

The cost of renting shelter is rising at the fastest rate since, well—the last inflation crisis. Annual growth of rents surged by 8.2% in October, the highest level since 1983. The bank’s calculations show it’s a whopping 7 points higher than the average seen in the 20 years prior to the pandemic. They previously warned it would be one of the drivers of sticky inflation, and it’s here.

All things are relative though. Sometimes rapid wage growth can drive rents higher. This isn’t one of those times.

“More importantly, the rise in rents is now far outpacing the underlying trend in personal income,” explains BMO Chief Economist Douglas Porter.

Canadian Rents Outpace Income For The First Time In 60 Years

For the first time in a half-century, rental prices are rising faster than incomes. Porter’s calculations show disposable incomes have average annualized growth of 3.9% over the past five years. He notes that it’s a touch above average inflation, but obviously nowhere near annual rent growth.

Source: BMO.

Many are unlikely to bat a lash at how unusual it is, but it’s an unusual situation. Not “good” unusual either.

“This is the first time in 60 years of records that income growth has trailed behind rents—and it’s not even close,” says Porter.

Rate Cuts Might Help, But They’re Likely To Make It Worse

Rising debt servicing costs are blamed, so the potential for rate cuts might fix this, right? Not exactly, since rising rental costs are likely just a delayed response to the record speculation.

Investors had been swallowing up the majority of new supply, often with negative cash flow. In other words, they bid up prices so fast they had to subsidize the monthly carrying costs. Back in 2017, nearly half of Toronto’s condo investors took possession of negative cash flow properties.

Central bank research shows holding interest rates excessively low for too long boosted home prices across the world. In Canada, this excess leverage helped investors capture even more of the market, displacing first-time buyers. The issue observed in Toronto has now spread to the rest of Canada.

Even without rising debt servicing costs, any moderation in speculation would produce higher rents as a transmission of excessive leverage.

Rents outpacing income isn’t just a first for Canada, or even a once-in-a-generation event. The scale that rapid leverage expansion drove home prices higher, and its transmission to rents, hasn’t outpaced disposable income growth since the collapse of the Bretton Woods agreement that led to the Great Inflation, and the birth of “too big to fail” banks. It’s a critical failure of the central banking system, and a once-in-a-global monetary standard event.

Adding a million strangers a year is causing this problem You don’t have to be a math genius to figure this out

Despite the unprecedented rise in rents, it seems that none of the three major federal parties are too concerned with renters. Their primary focus is mortgage holders and ensuring that these are the people who are able to continue to keep a roof over their heads.

And, as unpleasant as it may be, many mortgage holders have the option of extending the amortisation period of their mortgages to admittedly barely tenable lengths, but at least they are still able to protect their assets and keep a roof over their heads, while tenants are slowly being priced into the poor house.

In many parts of Canada, during the last few years, the pricing of housing was exacerbated by existing homeowners investing in rental properties, to the detriment of potential first-time buyers. These investors have been driving up the price of rentals with the intent of making the profit from their investment which they believe they are entitled to (apparently risk was never factored into their investment strategy), something only possible thanks to the feds ensuring that a million or more new renters are streaming into the county every year.