Canadians briefly thought the country’s central bank was owning up to, and correcting its mistakes. That pipedream had a bucket of cold water poured on it Thursday, as Bank of Canada (BoC) deputy governor Gravelle’s speech referred to a “long standing housing supply issue.” Adopting a popular but false political narrative didn’t sit right with BMO, which called it revisionism. Not even the central’s bank’s own indicators support the deputy governor’s attempt to divert attention from the low rate fiasco.

Bank of Canada Ultra-Low Rate Shock Ended Affordable Housing

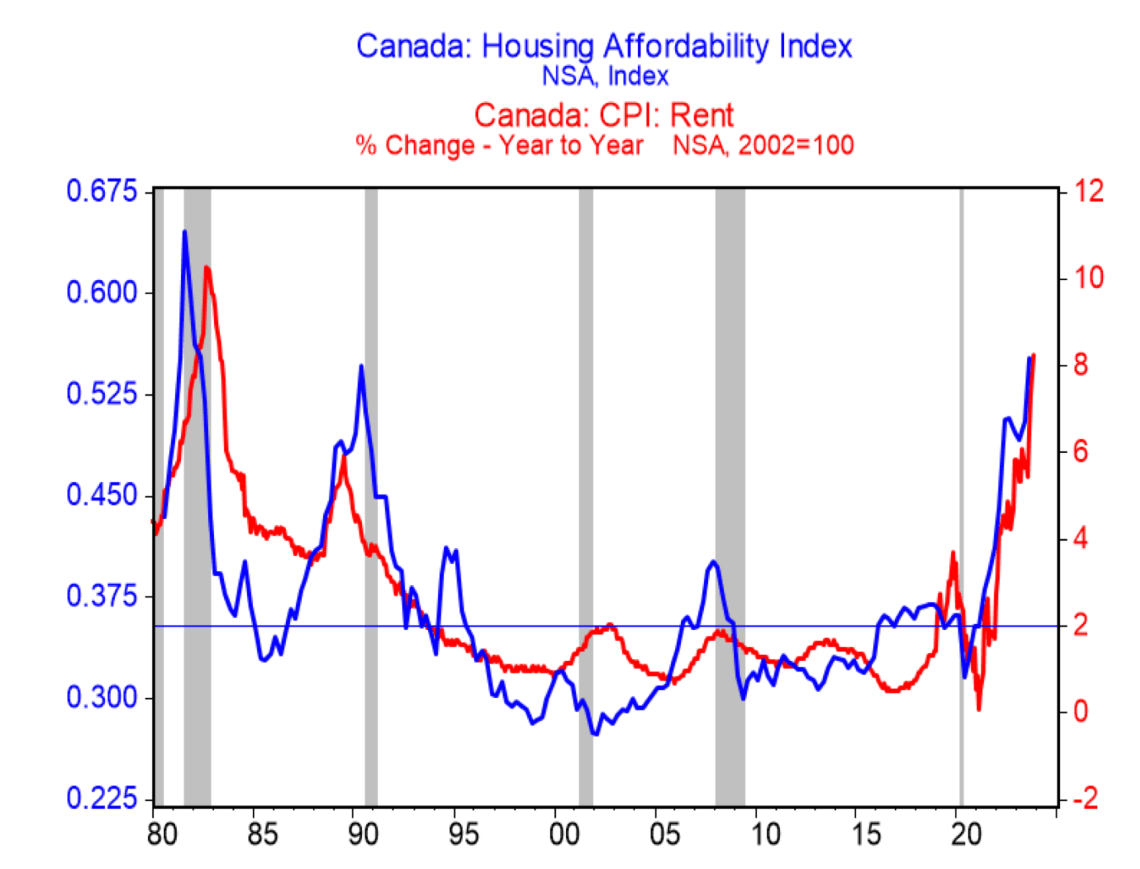

The BoC’s assertion that Canada has a long-time supply issue is challenged by its affordability research. The BoC Housing Affordability Index (HAI) shows the share of income a median household buying a home would have to dedicate to the mortgage. In the below chart shared by BMO, we can see between 1994 and 2019, the index is considered affordable.

Canada Housing Affordability Vs Rental Price Growth

Source: BMO Capital Markets; Bank of Canada; Statistics Canada.

“Even a cursory look at either the Bank’s own measure of housing affordability or rent inflation readily shows that there was no major issue prior to 2020,” explains Douglas Porter, chief economist at BMO.

“The fire was lit by a combination of ultra-low interest rates and then the fastest population growth in 50 years. The Bank’s own measures of home vacancies and new building versus household formation show that the true problem only emerged very recently, and this is not a ‘long-standing’ issue.”

Canadian Rents Are Rising, But It’s Not Entirely Due To Vacancy

The central bank also claimed tight vacancies would continue to apply upward pressure on rents. Once again, that narrative is at odds with the claim of it being a long-standing issue. That doesn’t mean rents will moderate anytime soon, but it wasn’t exactly a long-term issue.

“We have no quibble over the latter assertion, we just are not fully on board with the explanation of how we got here,” says Porter.

Adding, “Yes, rents had picked up from extraordinarily low increases by 2019, partly because StatCan began measuring rents differently.

A point worth considering that BMO didn’t mention is the relationship between low rates and speculative landlords. Most new supply is bought by investors that use low rates to bid up prices. These purchases were largely cash flow negative, meaning rents were insufficient to cover the increases. When cash flow negative investors dominate a market, they have a monopoly-like effect. Rents would have to rise to support the low rate purchases.

Canadian Recent Policy-Driven Population Boom Is Now Applying Price Pressure

What the BoC did get right is the recent record population growth has contributed to a squeeze. Federal policymakers used immigration as a stimulus tool, similar to how low rates are designed to bolster demand and thus inflation. It’s a lot easier to raise the immigration targets by 1 point and have demand drive GDP higher than it is to have an existing population expand by that amount. However, this strategy clearly isn’t without flaws.

“Yes, we can look back now, with the luxury of hindsight, over the past five years and the addition of 3 million people and say we did not have enough supply. But even record levels of new starts in 2021/22 simply could not keep up with that sudden tidal wave of demand,” explains Porter.

Previous research from BMO shows that Canada’s housing supply outgrew its household formation for two decades. Even in cities like Toronto and Vancouver, new housing outpaced the population growth. It wasn’t until recent policy changes were made for the population to intentionally outpace housing that it became an issue.