Canada’s once tight labor market, a key driver of wages and shelter costs, is loosening. Statistics Canada (Stat Can) data reveals job vacancies declined further in Q3 2023. The drop is a double-edged sword: roles being filled is good news, but job creation is failing to keep up with population growth. Canada is adding roughly 2 workers for every job filled, which will quickly transition a tight labor market to one with excess labor in a short period. Expect unemployment to rise and wage growth to fall if this trend persists.

Canada Is Seeing Its Labor Market Loosen Very Rapidly

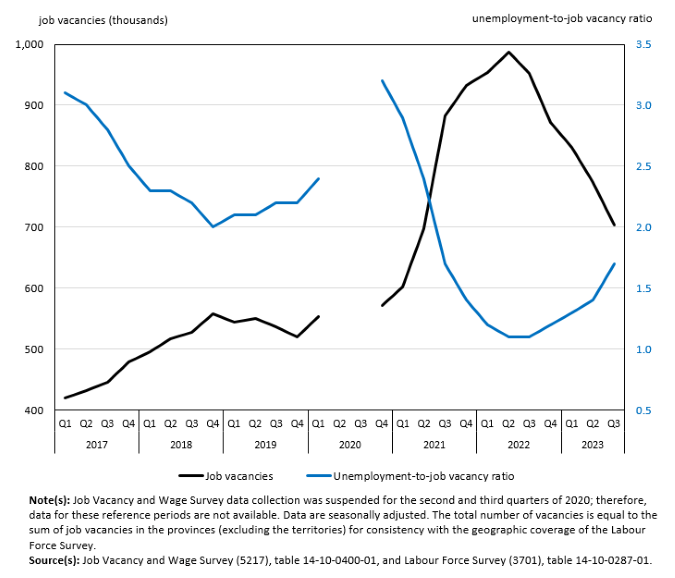

Canada’s job market saw a notable erosion in opportunity as fewer job openings are advertised. Vacant roles fell 9% to 706.1k in Q3 2023, representing 254k fewer openings than last year. This marks the fifth consecutive quarter of decline since the peak in Q2 2022.

Canadian Job Vacancies Are Plunging Lower

Unfilled roles are starting to become more widespread, with 26 of 69 economic regions declining. The biggest drop was in Ontario, which represented 42% of the decline. Most regions didn’t experience a decline, but the largest and most populous ones did.

The decrease in job vacancies is not uniformly spread across the country. Of the 69 economic regions in Canada, Stat Can found a decline in 26 of them. Ontario led lower, accounting for 42% of the overall drop. Most regions escaped the erosion but the ones that were hit tend to be the largest.

Canada’s Vacant Roles Are Concentrated In Low Wage Industries

The vacancy rate, the share of available roles as a share of total labor demand, fell 0.4 points to 3.9% in Q3 2023. It’s now at the lowest level since Q1 2021 after falling for five consecutive quarters. The distribution of these vacancies also yields more insight that isn’t particularly positive.

Canada’s vacant jobs are significantly concentrated in one area—sales and services. Over 1 in 4 (29.2%) of all vacancies were in this area, with nearly a quarter (47.5%) in a low wage role. The role, “counter attendants, kitchen helpers, and related occupations” offered $16.50/hour on average. In other words, low wage roles that would struggle to cover rent dominate the available jobs.

For context, we’ve all heard that Canada has a “trade crisis,” with a huge opportunity to fill roles. Trades and related roles represented 134.2k of the vacant roles in the quarter. If the country calls that a crisis, what does it call the lack of low wage workers in its sales and service industries? An immigration plan?

Canada’s Population Is Growing Nearly 2x Job Creation

There’s good news and bad news when it comes to what drove the decline of vacant roles. The good news—most of the jobs were absorbed, with payroll employment rising 0.6% (+117.6k payrolled employees). It’s significantly higher than the decline in vacancies, meaning most were likely absorbed instead of scrapped. It also marked the 10th consecutive quarter for payrolls to rise, meaning the country’s employment is on the rise.

Adding jobs is great, but it doesn’t mean a lot unless contrasted with the population. That’s where the bad news comes in—Canada’s working aged population added 2x as many people as the economy added jobs. We’ve discussed this a number of times, and how this trend is driving a higher unemployment rate.

Canada’s labor market is at a critical juncture. Jobs are being created rapidly, but they’re not keeping up with the explosive population growth adding roughly 2 workers per job. As a result, the country is quickly heading down the path of rising unemployment and excess labor.