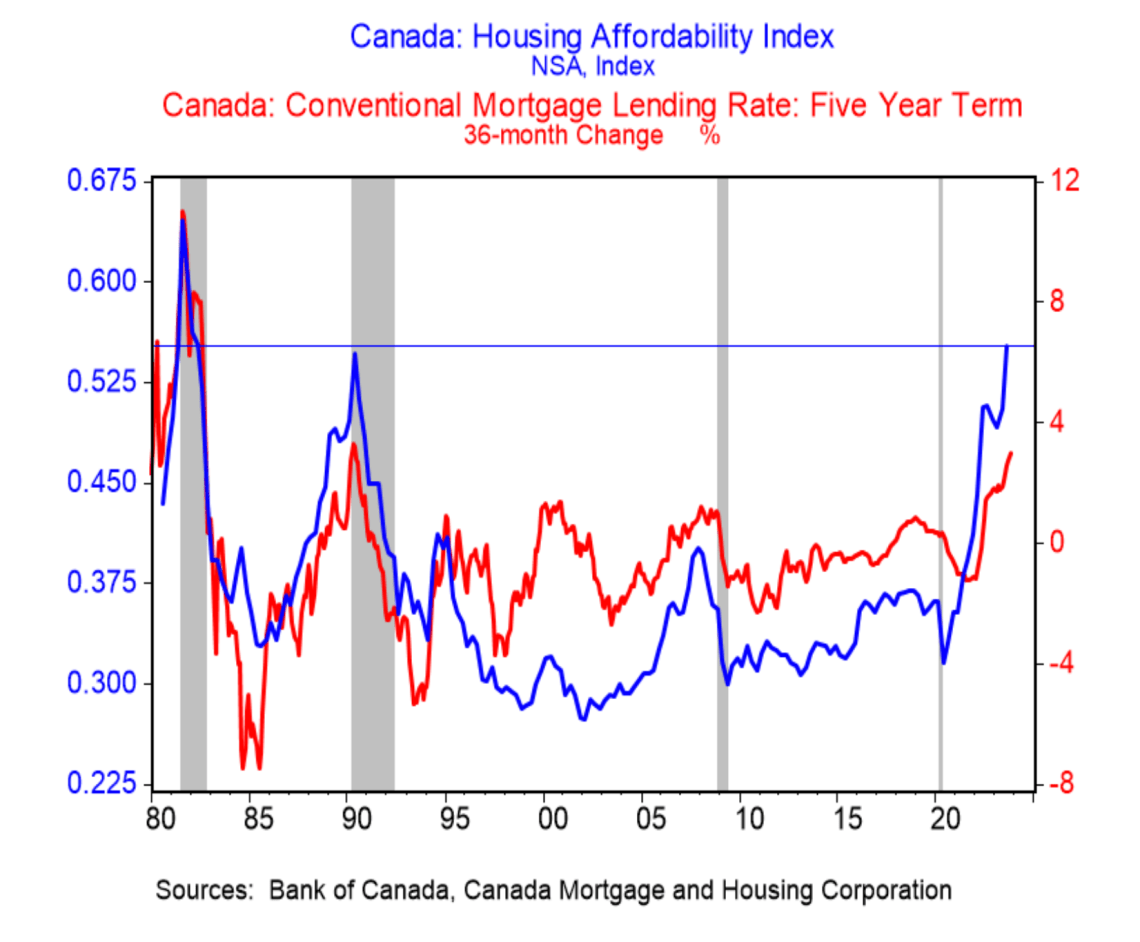

Canadian real estate is rarely this out of reach, and it’s always followed by recession. That was the take from BMO, noting further erosion in the Bank of Canada (BoC) Housing Affordability Index (HAI) in Q3 2023. Higher rates are finally slowing down the pace at which it worsens, but it hasn’t been this bad since the early 80s. The bank’s research reveals affordability at this level has always been followed by recession, and this time won’t be different.

Bank of Canada Housing Affordability Index At 2nd Worst Level Ever

The BoC’s index looks at the share of household income required to service a mortgage. Costs include monthly mortgage payments, as well as some utility costs. The higher the index, the greater the share of income a typical household would dedicate to shelter when buying a home.

The BoC calculations show affordability is now worse than the peak of the 90s real estate bubble. Households need to dedicate 55.2% of their income as of Q3 2023, rising 5.5 points from last year. This level of affordability is only surpassed by the inflation crisis in the early 80s, but let’s come back to that.

Believe it or not, higher rates cut the growth rate in half this year. From 2020 to 2022, the rate increased a whopping 12.5 points, as low rates fueled a surge in speculation and home prices.

“The Bank of Canada’s housing ‘affordability’ index took another big step to the wrong side in Q3,” said Douglas Porter, chief economist at BMO.

Canada may have always had cities that lacked affordability, but a national bubble is much more rare. Last week, the bank released a similar analysis revealing the pre-pandemic, long-term average of the index was 35% of income.

“ Since then, we have seen first a frenzy of speculative buying as rates were slashed to record lows, a surge in population, and then a spike in borrowing costs,” Porter explained.

Recession Always Follows Such A Sharp Erosion of Affordabilty

One insight that may jump out at even a casual observer is the sharp decline that typically happens after affordability reaches this level. Affordability suddenly improves after a brief stay at this level, which typically marks the popping of a bubble.

“Looking ahead, note that the three prior spikes in unaffordability (early 1980s, early 1990s, and 2007/08) were followed in short order by Canadian recessions,” Porter notes.

As shelter costs rise, it diverts funds from more productive areas like investing and consumption. The result is households have lower cash flow, leading to shrinking revenues for businesses.

Porter adds, “We expect the economy to struggle to grow in 2024.”

It’s not exactly hard to see why he feels that way.